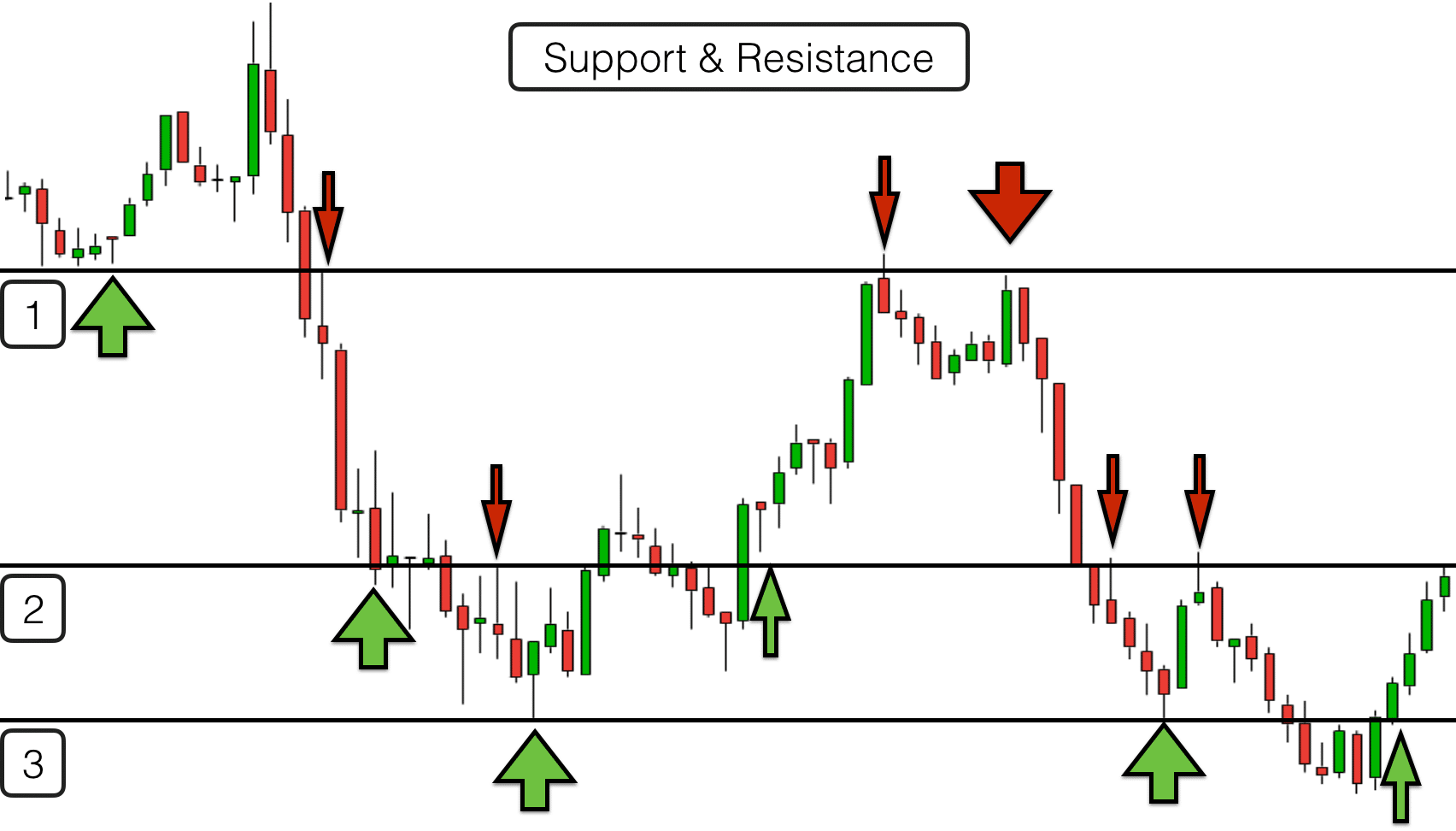

candlestick chart support and resistance. Technical analysts use support and resistance levels to identify price points on a chart where the probabilities favor a pause or. Support levels indicate a price point where increased buying pressure overcomes selling pressure.

candlestick chart support and resistance Simply put, this is a candlestick pattern that confirms key support or resistance. The simplest way to use candlesticks is with support and resistance levels. Using candlesticks with support and resistance.

This Pressure Can Come From Traders Who Believe That.

Seeing a candlestick pattern right at a known support or resistance level acts as a strong hint that the price might be about to change direction. Simply put, this is a candlestick pattern that confirms key support or resistance. Support levels indicate a price point where increased buying pressure overcomes selling pressure.

Technical Analysts Use Support And Resistance Levels To Identify Price Points On A Chart Where The Probabilities Favor A Pause Or.

It rejects the area in a way that shows me where bids (buyers) and offers (sellers) are positioned. The simplest way to use candlesticks is with support and resistance levels. Using candlesticks with support and resistance.

In A Trading Range, Candlesticks Can Help Identify Entry Points To Sell Near Resistance Or Buy Near Support Levels.

The list below contains some,.